Think services and investment, not just beef and tariffs: The EU-Mercosur Agreement is moving forward

This Saturday (17 Jan 2026), the agreement between the European Union and Mercosur will be signed in Asunción, Paraguay, after over 25 years of negotiation. Many businesses across all sectors have skin in the game, and many have high hopes - from service providers to renewable industries, from tech companies to exporters of European cheeses, from car makers to investors.

Ready to Samba? Possibly soon, but not quite yet

The EU-MERCOSUR Agreement finally signed – but is it actually approved? Well, it seems we will need to wait a little longer.

A few months ago, the European Commission presented the text to the Council, splitting the agreement into two:

Interim Trade Agreement (iTA) covering only those parts that are of exclusive EU competence, to be ratified and adopted after the confirmation of the Council of the EU by qualified majority – that’s what happened last Friday, thanks to Italy, which changed its mind after some concessions by the EU – and the approval by the European Parliament (next phase incoming);

EU-Mercosur Partnership Agreement (EMPA) covering the whole text, which will need to be approved by each Member State before entering into force. The iTA would expire once the full agreement enters into force.

While the iTA requires the consent of the European Parliament before being formally concluded by the Council, it could still be applied provisionally before those steps are concluded. Triggering this mechanism is in the hands of the European Commission – which reportedly has said it would not do so before the EP’s vote. But that could change – not least if the vote were delayed by a legal challenge.

If triggered, it would mean that the EP’s competency will be at least temporarily bypassed, which may add friction to the already charged atmosphere around this agreement. But geopolitical and other concerns may override such worries.

One thing is clear: Once the agreement officially applies, Member States who disagreed cannot refuse to implement it since trade policy is within the exclusive exclusive competence of the European Union as a collective.

But it’s not all about the EU alone, of course. On the Mercosur side, countries equally need to move forward with their ratification process for the agreement to enter into force. That may take a moment. In Brazil, for example, a free trade agreement is normally subject to the ‘complex procedure’ which requires approval by the National Congress. Once signed by the competent authority, the President, he/she must send it to the National Congress, where it must be approved by both the House of Representatives and the Senate, and then formally enacted by the Executive Branch. This can take up to four years – and Brazil has an election coming up in mid-2026.

Not just agriculture, not just tariffs, and not all at once

While most eyes (in Europe, at least) are on beef and other concerns of French, Polish and other farmers, it is important to remember: this agreement is not only about agricultural goods, nor just about tariffs. But both matter, so let’s look at them first. Important to note: changes will come in stages.

In 2024, the EU’s trade with Mercosur reached €55.2 billion in exports and €56 billion in imports, with 80% of the trade flow being with Brazil. The most exported goods by the EU to Mercosur were machinery and appliances, chemicals and pharmaceutical products, and transport equipment, while the most imported were agricultural products (yes, a lot of South American agri-content is already entering the EU), mineral products, pulp and paper.

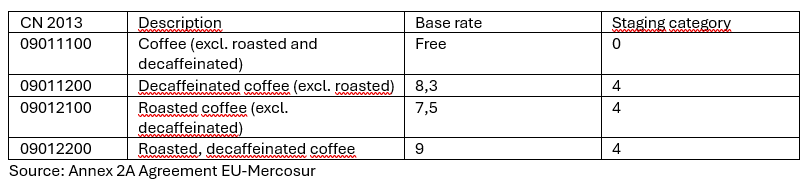

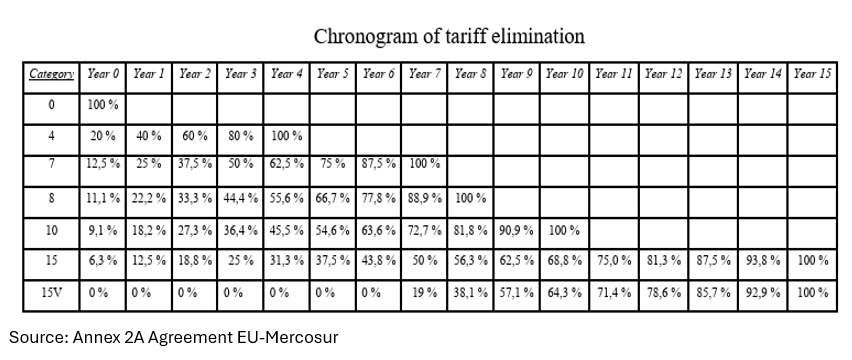

Not all products covered by the agreement will enter either the EU or Mercosur immediately tariff-free . In fact, products are governed by a tariff schedule which often provides for a series of staggered reductions, along with many other conditions, quotas, and exceptions detailed in the trade in goods chapter (and additional protocols). Here’s an example of what the tariff schedule in the EU-Mercosur agreement looks like – for South American coffee entering the EU.

This means that, once the agreement is in force, tariffs for roasted and/or decaffeinated coffee will be progressively reduced by 20% each year, starting on day one. After four years, the tariff will be zero.

Services and investment – open for business (but T&Cs apply)

While goods are indeed a major point of this agreement, there are many more potential market access and business development opportunities for both sides, such as in trade in services and investments.

Trade in services between the EU and Mercosur was worth over €42 billion in 2023, with the EU exporting over €29 billion to Mercosur and importing around €13.4 billion[1]. When it comes to investments, the EU is the largest investor in Mercosur countries, with an investment stock of around €390 billion (2023)[2].

But different from trade in goods, trade in services is not bound by tariff schedules (even though President Trump recently mused about applying tariffs on foreign movies imported to the US, it is in fact quite challenging to tariff cross-border services). Barriers here can, yes, sometimes come in the form of taxes, fees and other financial contributions, but most challenges for services and service suppliers come in the form of local regulations, restrictions on foreigners providing such services, local presence requirements, and so on.

To overcome these, the EU and Mercosur offer each other general concessions in the specific chapters (services/investments) in which they agree on basic principles such as mutual recognition, cooperation, reciprocity, etc. More specifically, they present a list of commitments to services. In this list, the EU Member States and the Mercosur countries indicate specific restrictions or concessions on market access and national treatment - so this is where they ensure that any protections they want to maintain are secure from challenges.

And this is what EU Member States have done in this agreement – for example:

Italy applies a nationality requirement for owners of publishing and printing companies;

France states that shareholding and voting rights may be subject to quantitative restrictions related to the professional activity of the partners in law firms providing services in respect of French or EU law;

Spain kept its state monopoly on the retail services of tobacco.

Similarly on the Mercosur side:

Acquisition of land in border areas (“security areas”) is limited to native Argentines. Foreign individuals and companies carrying on investment projects with a majority of Argentine personnel can acquire buildings and/or exploit of authorisation and concessions in Security Areas, only with prior authorisation;

Foreign capital in Brazil must be registered, under a declaratory and electronic procedure, with Central Bank of Brazil. In enterprises with three or more employees, two-thirds of the workforce must consist of Brazilian nationals who shall account for two-thirds of the payroll;

In Paraguay, every firm set up abroad that wishes to exercise its activity in the national territory must set up a representation in the country.

Want to know more about supplying services or investing abroad? Check out the new Access2Markets database on services and investments, for a start!

In practice, what most affects services exports and investments abroad are local regulations. The EU-Mercosur Agreement will help reduce red tape and make things easier, but of course local regulatory realities will remain important.

The key for investors and service suppliers is a good understanding of what applies to them in their target markets. For EU businesses, a good place to start for is always the EU’s ‘Access2Markets’ platform – check the EU’s My Trade Assistant database, in which key market conditions for different service sectors in a range of countries, including Brazil, are provided.

[1] Available at: https://www.consilium.europa.eu/en/infographics/eu-mercosur-trade/?utm_source=linkedin.com&utm_medium=social&utm_campaign=20260109-eu-mercosur-agreements-greenlight&utm_content=visual-carousel, seen 12/01/2026

[2] Available at: https://www.consilium.europa.eu/en/infographics/eu-mercosur-trade/?utm_source=linkedin.com&utm_medium=social&utm_campaign=20260109-eu-mercosur-agreements-greenlight&utm_content=visual-carousel, seen 12/01/2026